The unexpected knock-on effect of Trump’s minerals deal

Climate and Science correspondent

BBC

BBCListen to Esme Read this article

Donald Trump’s return to the White House is a “major blow to global climate work.” This is how Christiana Vigosus, former United Nations climate head, said after his election in November.

Since he took office, Trump withdrew the United States, which is the most important global climate agreement, the Paris Climate Agreement. According to what was reported, American scientists were prevented from participating in international climate research and removing national electric car goals.

In addition, his predecessor’s attempts to develop new green technology “a new green fraud”.

However, despite its history on the climate issue, Trump was keen to make a deal with the Ukrainian president on critical minerals. He was also interested in Greenland and Canada – both countries are rich in critical minerals.

Gety pictures

Gety picturesCritical metal purchases have been a great axis of Trump since he took office. These minerals are crucial in industries including space and defense, but in an interesting way, they also have another major use – to manufacture green technology.

Therefore, can Trump’s focus on getting these minerals have a harmful effect, and helping to open the capabilities of the United States in the green technology sector?

Illon musk effect?

Trump’s right man understands more than most of the importance of critical minerals in green transmission. The X and Tesla space – Elon Musk companies – depends greatly on critical minerals such as graphite (in electric cars), lithium (in batteries) and nickel (in missiles).

Elizabeth Holly, a co -professor of mining engineering at Colorado School of Mines, explains that every nation has its own list of critical minerals, but it generally consists of rare lands and other minerals such as lithium.

She says the demand flourishes – in 2023, the demand for lithium grew by 30 %. This is often rapidly growing in clean energy sectors and electric cars.

Within two decades, they will constitute approximately 90 % of the demand for lithium, 70 % of the demand for cobalt, and 40 % for rare land, according to the International Energy Agency.

This was worried about Musk from getting some of these minerals three years ago: “The price of lithium has gone to crazy levels! Tesla may actually have to enter mining and refining directly on a large scale, unless the costs improve.”

He went on to write that there is no deficiency in the element, but the pace of extraction is slow.

The position of the United States in the global race

The weak American position on rare land and monetary minerals (such as Cobalt and Nickel) was addressed in a report published by the United States Government’s selection committee in December 2023. She said: “The United States must rethink its political approach to the chains of supplying the rare mineral and rare elements due to the risks that our current dependence on the People’s Republic poses.”

Warning that failure to do this may cause “defensive production” to stop and strangle the manufacture of other advanced technologies.

China’s dominance in the market came from its early awareness of the economic opportunities provided by green technology.

“China has taken a decision about 10 years ago about the place where the direction was going and strategically continued to develop not only renewable energy sources, but now dominates the electric market, and now dominates the market,” says Bob Ward, Director of Policy at the Grantham Institute for Research at the Grantham Institute for Research on Climate Change and Environment.

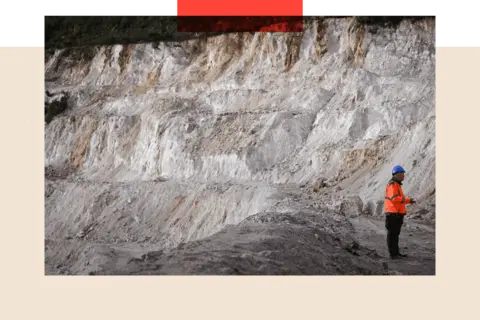

Gety pictures

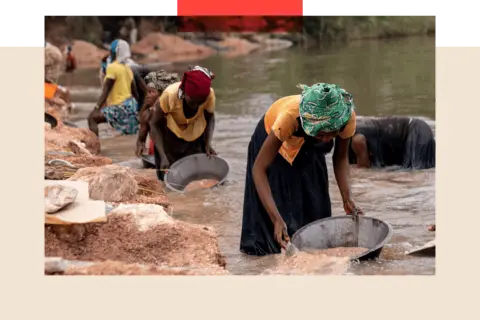

Gety picturesDaisy Jennings-Gray, the head of the prices at the reporting of metal prices, explains that it is critical minerals because it is geological restriction. “You cannot ensure that you have economically recovered reserves in every country.”

Some minerals such as lithium are abundant on the floor, but are often found in hard -to -reach places, so the logistical services for the mining project may be very expensive. In other cases, there is a dependence on one country that produces a large share of the global show – such as the Cobalt from the Democratic Republic of the Congo. This means that if there is a natural disaster or political turmoil, it has an effect on the price, says Ms. Jennings Gray.

China has managed to increase the supply by investing heavily in Africa and South America, but it has a market in the market (or separating the metal from other elements in the rock).

Gety pictures

Gety pictures“China represents 60 % of the global rare land production, but it treats approximately 90 % – [it] Grassillin Baskran, director of the critical metal security program at the Center for Strategic and International Studies in Washington, DC, says he is dominant at this stage.

She says that the country understands how important this is in economic trade – a few days after Trump provided a tariff on China, whose government has received export controls on more than 20 critical minerals, including graphite and tingstin.

Christopher Kniel, professor of applied economics at the Massachusetts Institute of Technology (Massachusetts Institute of Technology), says that what motivates Trump is the fear that it will be in a non -favorable position.

“I think what leads this is that China is the dominant player on the treatment side,” he says. “It is this treatment stage, and it is the high margin stage of work, so China makes a lot of money.”

As he put it, it is a “happy coincidence” that may end up supporting green technology.

The main question, however, is whether the United States is too late to take full advantage of the sector.

A blatant warning to the United States

In the early days, the green transition was “framed as a” bone “for the countries, according to the Bob Ward from LSE.

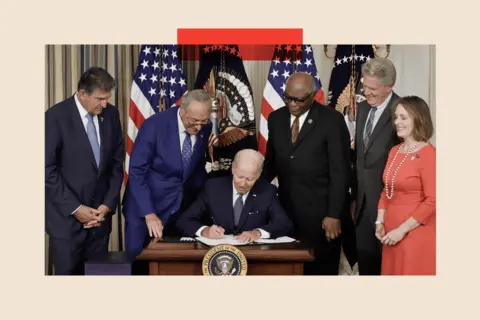

The Biden Administration was very supportive of green technology industries by submitting the IRA in August 2022, which provides tax credits, loans and other incentives for technologies that reduce greenhouse gas emissions, from battery technologies to electric cars to solar panels.

By August 2024, it was estimated that he had brought $ 493 billion (382 billion pounds) of investing in the American green industry, according to Think Tank Clean Investment Monitor.

Gety pictures

Gety picturesHowever, little work has been done to support source operations such as obtaining critical metals. Instead, the BIDEN management focused greatly on the manufacture of the estuary – the process of obtaining products from the manufacturer to the final consumer.

But Trump’s recent moves to buy these critical minerals indicate that the focus on the source process may happen now.

“The Irish Republican Army has put a lot of legislation in places to reduce trade and offer only from friendly countries,” explains Ms. Gray.

“Trump changes Tac and looks at securing critical metal agreements that owe something to the United States.”

Another executive whispers

There can be more moves from Trump to go on the line. Those who work in this sector say that the whisper in the White House corridors indicate that it may be about to issue a “executive for decisive minerals”, which can lead more investment in this goal.

The fine details that may be included in the executive matter remain unclear, but experts are aware of this issue that they may include measures to accelerate mining in the United States, including rapid tracking and investment permits to build processing factories.

Although the work may be currently underway to secure these minerals, Professor Willie Shih from Harvard Business College believes that the American administration lacks the technical complexity of the creation of metal supply chains, and emphasizes commitment to the required time. “If you want to build a new mine facility and processing, it may take 10 years.”

Gety pictures

Gety picturesAs a policy of his predecessor, which is clearly supportive of the climate, Trump was an audio to preserve the Irish Republican army. But its success in the red countries means that many Republican Senate members were trying to persuade him to preserve it in some way in the proposed “big and beautiful bill” – a plan to accommodate all the main Trump goals in the huge policy one – is scheduled to be revealed later this month.

My analysis by clean investment monitoring in the last 18 months, Republican -controlled countries received 77 % of the investment.

Dr. Knights of the Massachusetts Institute Liknak says

He adds that the failure to do so is a real political threat to us, actors who suffer from his re -election in less than two years.

If Trump loses to only one seat for Democrats in the middle of the period 2026, it loses the majority of the House of Representatives – which limits its ability to pass the main legislation.

Gety pictures

Gety picturesKarl Fleming was a consultant for the former men of men’s consulting committee in renewable energy and energy efficiency, a partner at the McDermott and Will & Emery, as they advise customers in the field of clean technology and energy. He says that despite uncertainty, investors remain confident. “Last month, my practice was more preoccupied than ever, since Quadrupling last year after the Irish Republican Army.”

He also believes that there is a recognition of the need to preserve parts of the Irish Republican army – although this may be alongside the expansion of some fossil fuels. “If you are really trying to be” American First “and Energy Secure, you want to get all your cranes. Keep solar energy and keep the battery storage continuously and add more natural gas to launch energy ingenuity in America.”

Bob Ward from LSE says that the uncertainty in the American position is a little condolence for its absence on the international climate. “When the Americans are on the ball, it helps to move people in the right direction, and so we got the Paris Climate Agreement.”

For those in climate space, Trump is definitely an environmental expert. What is clear is that he is not interested in making his legacy environmentally but economic – although he can achieve the first if he can be convinced that he will enhance the economy.

The highest credit photo: Getty Emus

BBC It is the home on the site and the application to get the best analysis, with new views that challenge the assumptions and deep reports on the biggest issues of the day. We offer a thinking content from all over BBC Sounds and IPlayer as well. You can send us your notes in the INDTH section by clicking the button below.

https://ichef.bbci.co.uk/news/1024/branded_news/e08e/live/7b06d6b0-001e-11f0-a8b1-950887ddc6e5.png

2025-03-14 01:26:00