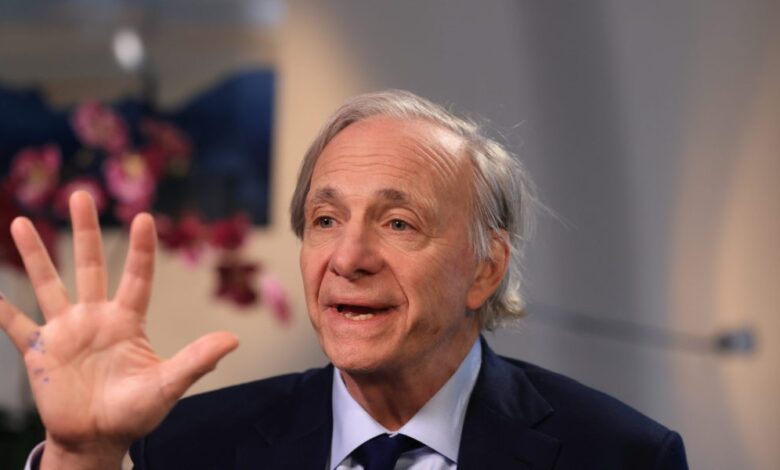

Ray Dalio says Trump’s ever-changing tariff policy could contribute to a problem ‘worse than recession’

- Ray Dalio warns of President Trump’s introductory policiesIn addition to high debts and global tensions, it can lead to the collapse of the “monetary system” in the United States, causing much more severe disturbances than the typical recession. It compares the current circumstances with the thirties of the twentieth century, referring to the dangers of internal political conflict, international power transformations, and economic instability that can escalate to a global crisis if it is managed badly.

President Trump’s changing tariff policy is part of a broader set of economic and geographical pressures that can lead to a “worse stagnation” crisis, according to the founder of Bridgewateer Associats Ray Dalio.

Dalio, who appreciates his pure wealth 16 billion dollarsHe said in an interview with NBC’s Meet The basis of the American economy – the “monetary system” – is threatened. He warned that the collapse of this system may have much deeper consequences for consumers and companies from standard economic deflation.

Dalio said that history is formed by five major powers: cash courses such as credit and debt; Internal political conflict; Transferring global energy dynamics; Technological change and natural disasters such as epidemics. In his opinion, all five playing.

The Trump administration’s tariff agenda – which was placed in sudden ads, repercussions, and exceptions – sees as a symptom of policy makers who are struggling to manage these broader transformations.

The initial tariff targeting China followed the delay against Mexico and Canada, aimed at curbing fentanel and slowing migration.

Additional duties have been detected on industries such as cars and steel as part of a campaign called “Liberation Day”, with a 10 % blanket tariff presented on April 2.

Higher rates were imposed on chosen commercial partners such as the European Union, Japan and India, although they were given a 90 -day delay. China, which imposed a retaliatory tariff, was excluded from stopping.

On April 5, the White House moved to the exemption of smartphones and computers imported from China, after concerns about the enlarged American trade deficit.

He studied in history with blatant warnings for the future

Dalio criticized the chaotic show.

He said: “What has been placed there [in the April 2 tariff announcement] It was like throwing rocks in the production system and these effects will be enormous in terms of the efficiency of the whole world.

“At the present time, we are at the decision -making point and are very close to the recession. I am concerned about something worse than stagnation if this is not treated well.

“The recession is two negative quarter of GDO, and if there is always? We always have these things. We have something more deep, we have a collapse of the monetary system – we will change the cash matter because we cannot send money amounts.”

The 75 -year -old economist may refer to the issue of government debt, the most prominent of which is.

Many – including Jpmorgan Chase CEO Jimmy Damon and Chairman of the Fed Jerome Powell – America may continue to collect public debts to the point that he cannot pay it, which leads to a position where foreign countries raise their prices to Uncle Sam or simply refuse to buy their debts.

However, Dalio added the customs tariffs and changes in the local system and the world group.

“Such times are very similar to the thirties of the twentieth century.” “I studied history, and history is repeated again and again. If you take the definitions, if you take debts, if you take the growing power in challenging the current power … those changes in requests – the systems are very disabled. How can it be dealt with from producing something that wears a lot of stagnation or can be treated well.”

The worst scenario

Dalio’s worst scenario includes a collapse in the value of money, internal political conflict “not like the democracy we know”, and global tensions that can escalate to military conflict.

“These breakdowns have happened before,” he said. “The current monetary and geopolitical system began in 1945. These systems are going in cycles, and I am concerned about the collapse – especially as it should not happen.”

This story was originally shown on Fortune.com

https://fortune.com/img-assets/wp-content/uploads/2025/04/GettyImages-2195610382-e1744626624900.jpg?resize=1200,600

2025-04-14 11:13:00