Raunchy R-Rated Comedy With Marvel Star On Netflix Makes Adults Grow Up

by Robert Scotchi

| Published

One of the most important aspects of Apato outside This is 40 It is how he decided to throw Paul Road and Lezli Man, two people who appear to be able to show any signs of aging. Regardless, this is “the type of completion” Knock She has legs, and she is one of the best ROM Koms Shenn from 2010 because of her reasonable family dynamics. Well, by “believing”, I mean that as a married person and on the wrong side of the thirtieth, I have suffered from similar quarrels with half better about feverish lifelong, and how I sometimes should make executive decisions with children when they are not present in it.

but, This is 40 It makes me wonder from partners, with both failed companies, able to withstand such a luxurious style that includes a huge house in suburbs, personal trainers, and the ability to go to expensive romantic Getaways (in the BMW that they own) when they claim that they can barely pay the mortgage.

But if you are ready to suspend disbelief while watching movies like RockThen I think I can be a little tolerant because of This is 40 Fill in rapid dialogue and some of the at home that can be often believed.

A family in distress

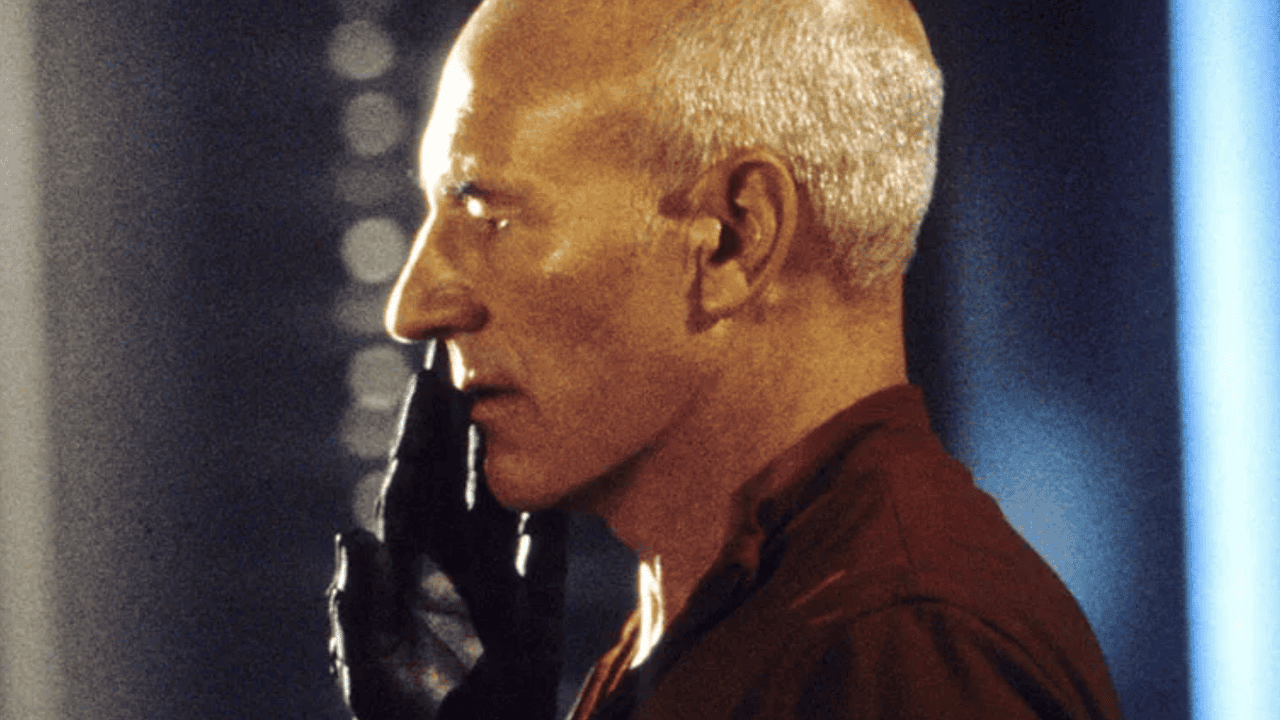

This is 40 He starts with a fuss, literally, where Paul Rudd’s house gets an ear after he revealed to his wife, Deby (Leslie Man) that he took Viagra before engaging in a steam saturated shower. This opening scene determines the dynamics of the relationship between Beit and Dipi completely because it lights up their horror in communicating with each other.

A house, which is clearly attracted to his wife, simply believed that the emergence of private blue birth control pills would add some excitement to their sexual lives, as both of them approach their fortieth birthdays in the title “entitled” This is 40. On the other hand, Debie feels insecure because of the fact that Pete needs a pharmaceutical help to accomplish the task because the sub -text you pick up is that it has become less attractive with her age.

While both Beit and Dippei are trying their best to manage their family, and raising their two daughters, Sadi, who is 13 years old (Mood ApatoThe 8-year-old Charlotte, they continue in their own way because they are both sad and nervous in unique ways-Dibi is obsessed with control that tries to be a friend of her children while they also rule the house with the iron fist, while the parents ’house is approaching in a more relaxed way while it is on the taste of everyone in the arrest of the external match.

Financial stress will destroy anyone’s day

In the middle This is 40Outside the dynamics of the family, a house is struggling to make the failed record mark a profit. Beit, who was far -fetched with HP, believes that Graham Parker & the Rumor Reunion will get his company out of red, but he is struggling to sell 1000 downloadable copies of her new album. What made matters worse, a house was supporting his father financially, Larry (Albert Brooks), who had three young twins.

Deby fashion in This is 40 It is not without issues as well, as one of its employees was rid of the bank’s bank to $ 12,000. While Paul and Deby tries to take these battles independently, their marriage is placed on the rocks when Deby visits the family accountant and discovers the comfort of their situation in reality.

It cannot blame them for trying

Although the above problems are sufficient to make anyone who wants to drive his bike from the abyss, This is 40 It illuminates the accuracy of its main characters with stress sources. Beit and Deby not just trying to keep their marriage standing on his feet, although they are barely in the corner of each other on the home front, but they constitute an unjust all an alliance whenever they need to climb and parents in reality for their children. Even when you think so This is 40 It will end in divorce, and there is no reason to believe otherwise, the house of Dipi is the power of nature when they discover that Sadi is exposed to intimidation in school by a child like Tom Betty Factory.

What’s more, there is one bright moment in This is 40 When Pete and Debbie are able to sneak out of the house for a romantic smuggler, and they laugh at health while discussing how they will kill each other if they are somewhat paid, he no longer has a conversation, a conversation that most friends married – Real crime He was with each other at some point for fun.

Better than critics will lead you to belief

Surprisingly, This is 40 It only has a 52 percent critical degree compared to popcorn by 50 percent Spoiled tomatoesWith its most common criticism at the time of its 133 -minute operation. Although I usually love a 90 -minute narrow movie, I did not think personally This is 40 It is ever pulled, because it is a kind of life segment. Marriage, family education is the most exciting, terrifying and reward that anyone can do, but there are also very boring windows so that you sometimes need to sneak into the bathroom to play Candy Crush In order to feel life.

While you may not be able to This is 40 It picks up worldly moments, and adds these unpopular small exchanges to the movie because it makes everything look real.

Until writing these lines, you can broadcast This is 40 On Netflix.

https://www.giantfreakinrobot.com/wp-content/uploads/2025/02/This-is-40-2012-Feature.jpg

2025-02-26 15:25:00