Netflix stock has been nearly unscathed by Trump tariffs. Some think it could be Silicon Valley’s version of Johnson & Johnson

- The consumer’s basic stocks tend to perform well In stagnation with customers continuing to buy the basics. while Netflix You can see the numbers of subscribers decrease during the decline, and some bulls indicate that the broadcast service may be one of the last things that people want to abandon when their wallets become lighter.

He caused President Donald Trump’s tariff stock marketBut a Netflix investor may not notice. While the S& P 500 normative index decreased more than 10 % this year, Netflix shares More than 8 % rose in that period, even after the stocks reduced its gains when the broader market went to Free fall Earlier this month.

One of the clear reasons the stock achieved well: Definitions On the goods do not directly affect the broadcast service. Although subscriptions can cause great success during the recession, the company’s dominance in a notorious competitive industry has some analysts given if The primary element of the consumer This can do well when its clients become much lighter.

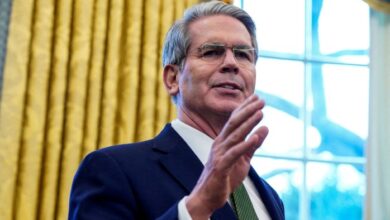

Or, as Edward Jones Senior analyst Dave Hegel, Netflix may occupy space cable TV before appearing Cut. He said that while consumers may diminish going to restaurants, cinemas or concerts when the times become difficult, they tend to continue watching TV.

He said: “I think Netflix may have this kind of flexibility in a state of stagnation.”

While the recession is afraid in Wall Street, the Netflix Administration is still session Long -term ammunition goals. The company aims to double the market value to $ 1 trillion by 2030, Wall Street Magazine I mentioned Monday, joining a club currently occupying only eight companies around the world. To get there, Netflix believes that it can double its revenues and invent its operating income in less than five years.

These are noble goals, and Hegel said. However, the shareholders have been rewarded in a rich way to bet on the company, as the value of their property increased by about 30 % on an annual basis in the past decade, compared to the annual gains of about 10 % for S&P in that period.

“You cannot really reduce their status if you look at the amount of turmoil they were in this industry,” said Hegel of the Netflix Administration.

It has made the uncertainty in its mark in the profit season, with Many companies Drag or reduce their instructions forward. United Airlines even Display Two different groups of criteria for the rest of the year depending on whether the American economy is weakening but remains stable or enter into complete recession.

However, if Netflix managed to confirm or raise their guidelines when profits are issued after the market closed on Thursday, it may be distinguished from companies that are struggling to deal with not only customs tariffs but also relatively high interest rates, said Brian Molberry, director and manager of an investment archives in Zacks. He compared to Johnson and Johnson.

“This is an essential moment for the management team to show strength,” he said.

Can the Netflix trade war help?

Hegel said that he will not necessarily be surprised if the administration decides to strike a cautious tone, but it is likely that the customs tariff may not be the problem that is looming on the horizon for Netflix is for companies in many other industries. As with online advertising for Amazon and DeadNETFLIX’s revenue flows appear to remain unattended at the present time.

One thing that can change is if they are countries, especially in the European Union, they raise taxes on Digital services Hegel said that revenge on the American customs tariff. While America is a pure source in this category, the drawings were a target for Trump angry since his first term.

However, Netflix may indirectly benefit from a clear capital of the United States The dollar weakensHe said. The strength of the dollar before the definition weighing revenue weighing from abroad, as the company finds most of its new subscribers.

Meanwhile, the power of foreign language programming in Netflix is a major reason because the company has a “very good recipe” to continue to increase revenues in an economic slowdown, Mulberry said. This is what happened during the initial economic shock at the beginning of the Covid-19s, although people were stuck at home.

“Are consumers still paying their contributions and discussing their offers?” The berries said. “This will be the most important question that we don’t have to answer.”

Bulls believes that Netflix is one of the last things that consumers will be ready to abandon.

This story was originally shown on Fortune.com

https://fortune.com/img-assets/wp-content/uploads/2025/04/GettyImages-2209802417-1-e1744842131447.jpg?resize=1200,600

2025-04-17 11:05:00