Japan to court Tesla on Nissan investment

Digest opened free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

A high -level Japanese group that includes a former prime minister has developed plans for ELON Musk’s Tesla to invest in the April Auto Maker, after the collapse of its merging talks with the Honda competition.

The new proposal, led by former Tesla Board member Hiro Mizuno, is supported by the former high Yoshheed Suja and his former assistant Hiruto Isomi, according to three people who have a direct knowledge of the move. Many members of the Board of Directors in April You realize the initiative.

The group is optimistic Timing It will become a strategic investor because they believe that the largest pure electric car maker in the world are keen to obtain Nissan factories in the United States, according to the people. The factories will help them enhance local manufacturing in response to the threats of Donald Trump’s tariff.

The approach plan from Tesla comes after April Go away From the proposal to integrate Honda worth $ 58 billion, which raised concerns that the third largest car company in Japan can fall into a possible foreign hands, with the assembly of the iPhone, activists and private stock groups around it.

Honda conversations were originally running after Foxconn approached Nissan Renault’s partner last year about buying some of its share in the Japanese auto industry. After collapsing in negotiations this month, Foxconn She confirmed her attention In obtaining Nissan shares as a way to expand its work in the field of manufacturing EV.

Suja, who stood by the Prime Minister in 2021, remains an active figure in Japanese policy, and continued as a member of the House of Representatives in Japan. He started his political career in Yokohama, where the Nissan headquarters is located.

The suggestion is a union of investors, with Tesla as the largest supporter, but also includes the possibility of investing the minority by Foxconn to prevent full acquisition by the Apple Supplier.

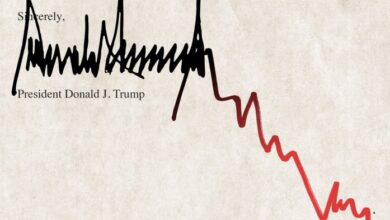

Nissan’s shares increased by up to 11 percent in Tokyo on Friday after the Vinanchel Times times were informed of the plans.

Nissan and Azumi refused to comment. Mizuno, Suga, Tesla and Musk did not immediately respond to the suspension requests.

In recent weeks, Nissan has started her own search for a strategic partner in the technology industry, as some members of the Board of Directors refer to Tesla and Apple as perfect goals, according to two other people knowing this issue. In November, it was launched Emergency transformation plan This included 9000 business losses, as it decreased to a quarterly loss.

With the 1.1 -Trin market value, Tesla is among the most valuable companies in the world. Historically, it has not been invested in car companies, and a Music burns the company’s concentration and spending it on $ 36 billion in cash for independent driving and robots.

But it also wants to enhance production in the United States to make up for the impact of the threatened definitions of President Donald Trump. The group collects all its cars sold in the United States locally, but the sources of some of its components of Mexico and other parts of the world.

Nissan has assembly factories in Tennessee and Mississippi with a combined annual capacity of about 1 million vehicles, but it produced only 525,000 units there in 2024. As part of its restructuring, the company announced plans to reduce production capacity by 20 percent worldwide to treat sales. Last week, she said she plans to reduce transformations in American plants.

Nissan may not easily accept the sale of American plants to its opponent, given that the local market is a major profit growth field.

Since Foxconn’s interest in Nisan in recent months, officials of the Ministry of Economy, Trade and Industry in Japan have been very concerned about the political effects and the strength of the national security examination to deal with Foxconn, which is seen as very close to China.

It was difficult to justify the prohibition of the deal because Japan welcomed the investment of the major conductors from Taiwan and previously allowed Renault to obtain a stake in Nissan and Foxconn to buy sharp, according to Japanese government officials.

After restructuring its alliance in 2023, Renault wants to sell a large part of 36 percent that he still owns in the Japanese group with a high allowance.

In an interview on Thursday, CEO Luka de Miu said that any proposal is required to reflect the value created through the 25 -year -old partnership.

He said: “I just hope that the Nissan Administration team will find a way to make it work better than it has been working so far.” “Give them all the support they will need.”

Additional reports by Stephen Morris in San Francisco and Joe Miller in Washington and Ian Johnston in Paris

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F5169c2ae-d1b5-4d02-9e07-9a6a9443dedb.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-02-21 05:32:00