Gene Hackman ‘loved acting and hated everything that went with it’

Gety pictures

Gety pictures“He loved to be an actor, and he hated all the things that surround her being an actor.”

This, for the film director Barry Sunfield, is how Jin Hagman, who died at the age of 95.

Sonnefeld told BBC News that the endless hours of hair and make -up, frequent taking, and all studio note frustrated Hakman.

Also, the actors who appeared not to know their lines – especially John Travolta, who clashed with Hakman in the 1995 Get Shorty movie, directed by Sonnenfeld.

In the days after the news of Hakman’s death, I was talking to people, such as Sonneenfeld, they knew and worked with him.

What is clear immediately is the extent to which Hakman is seriously acting, and how he carefully handles text programs.

But what is also clear is that he was wary of Hollywood decorations.

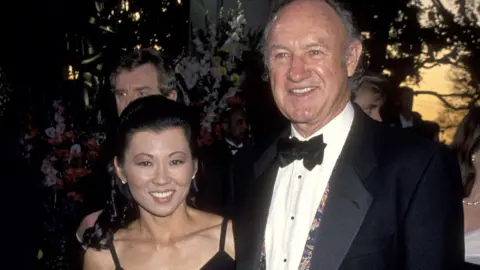

Hagman, an Academy Award winner, died twice, alongside his wife, Petsey Arakawa, 65, and their dog at his home in New Mexico. No cause of death was given, but the police said that the situation was “suspicious” to achieve entitlement.

The officials said on Friday Evidence points After Hackman died since February 17, 10 days before the bodies of husbands were found.

“Fear of God for me”

Here in Los Angeles, Hakman’s face is everywhere on television and newspapers.

Everyone was talking about while the stars gathered for pre -Oscar parties.

I was in one of these events on Thursday night, when American actor John Si Riley told me that he expected the Academy to be accumulated on Sunday. “I don’t see how you can have an Academy Awards ceremony without a great mention like the one who passed.”

For Sonneenfeld and Irish director John Moore – who brought Hackman in 2001 behind enemy lines – Hackman’s way of dealing with the texts that showed his brilliance. He removed all the screenwriter’s observations on how his personality delivered his lines.

“Because he does not want any screenwriter to tell him how he was supposed to feel at that moment,” Sonfield said.

“So he had unique texts and paste it did not have information from the writer about anything, because he wanted to make these options, not the writer.”

John Moore

John MooreMoore recalls a similar incident from the first time he photographed with Hakman.

He said: “He was sitting quietly there, taking text pages, cutting them, and removing strange things like the descriptions of the scene, and then grabbing them on empty pages.”

Hakman told him, “Acting is my job, you are doing the rest.”

Moore said, laughing, “Fear of God has put me in me.”

“It was scheduled to say:” I don’t need anything, because I am in this way. It is better to bring your game A, and I bring me. “

Gety pictures

Gety picturesIt was not just unnecessary studio notes that bothered Hackman.

Sonnefeld said: “He was exposed to this struggle that this was the wonderful actor but he hated Trops for what it takes in the films,” said Sonnefeld.

“[He] Hate makeup. Put on a wardrobe. The cabinet after takes it, take the lips brush and rub his wardrobe. He said that the makeup person returns his hair to talk to me. “

“All this kind of hair, makeup and all these things, I think that pushed him crazy.”

Moore said that he often does not want social communication after filming.

“I will try to drink a drink with him after the shooting, and we go up to the small bus,” he said.

“He had one, that was. [Betsy] It would give him this appearance, and it will be to sleep. He was in good condition in the morning as a result. “

“For gene, it was all about acting,” Sonnefeld added. “The end of the story. Get me out from here as soon as possible.”

The confrontation with John Travolta

Gety pictures

Gety picturesSonfield said Hakman could be a “hard actor” to work with him. “He did not suffer from fools.”

In Get Shorty, Hackman starred alongside Travolta, which plays the role of Miami Mobster he sent to the debt collection.

Sonnefeld said: “Jin was a prominent actor, technically and artisticly. So he came every day he knows his lines,” Sonnefeld said.

“John came to put the lack of knowledge of his lines, and he may not read the scenario the night before.”

This led to a confrontation on the first day of filming.

Sonnefeld Travolta – who describes him as “magician but does not realize the self” – asks Hackman what he did at the weekend.

Hakman replied, “Nothing but learning lines,” Travolta answered, “Well, this is a waste of the weekend,” according to Sonnenfeld.

As filming continued, Hakman grew “angry and strange” in his co -star, who does not know his lines.

Sonnefeld said he allowed Hackman to take out his anger at him.

“During the next twelve week, he was screaming at my face whenever John did not know his lines,” he said.

“But it is wonderful in a movie. I knew he was never angry at me.”

Gety pictures

Gety picturesAccording to what was reported, Travolta was not the only one who realized Hakman in a wrong way.

According to what was reported with others, including Wes Anderson, Royal Tenbum director.

Later, perhaps by chance, Hakman was appointed one of his novels escaping from Andersonville.

Bill Murray, who participated with Hakman in the movie “Jin” really on Weiss. Interview with Associated Press.

“It was a difficult nut, Jin Hakman. But it was really good.”

For his part, Moore said that he had never felt that Hakman was difficult to work with.

“He was patient and unabated, unabated,” he said.

“My memories are laughter and smiling, and I tell very funny jokes.”

Moore admitted that Hakman may have become angry at anyone on a group that made his role larger than he was.

“So I was able to see how it might be funny about the actors who were wandering in themselves,” he said.

“But again you return to this point – he really wanted to make films exceptional.”

Gety pictures

Gety picturesHackman has retired from acting in 2004 and since then he lived a quiet life in New Mexico with his wife.

“I think one of the reasons that led to his move to Santa in, again, in the open air, and away from Hollywood as possible,” said Sonnefeld.

In 2008, Hakman conducted a rare interview with Reuters, where he was asked If he misses acting.

He replied by saying that, for him, the work was “very stressful.”

“The concessions that you have to make in films are just part of the monster, and I have reached a point where I did not feel that I wanted to do this anymore.”

But he added: “I miss the actual acting part of it, because what I did for nearly 60 years.

“And I really love it.”

https://ichef.bbci.co.uk/news/1024/branded_news/d5ac/live/091466f0-f685-11ef-8c03-7dfdbeeb2526.jpg

2025-03-02 00:04:00