History suggests a tariff-induced downturn may cause a reckoning in the venture capital industry

There is a talisman that you learn as a business journalist –Follow the money.

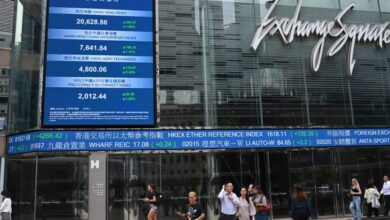

It is a talisman that you feel especially important at the present time, as the definitions are expected to enter into force tomorrow. The Nasdaq boat was swinging towards the bear market for the first time since 2022, as companies are preparing to suddenly rise in the costs of imported goods. There was a lot of gossip about companies that would suffer more than the result. But if you are sitting in the world of private markets, as many sheet readers do, you are likely to look at what is happening through a very specific set of lenses-so you are not in the color of roses.

Let’s start with the pipeline in which the money flows in private markets. Startups or small private companies are funded by investment capital companies or private stock companies that are funded by limited partners. We don’t always talk about this LPS enough (perhaps because it tends to be very calm and we do not say much in public places). But their money – endowments, pension boxes, sovereign wealth boxes, non -profit organizations and family offices – are behind the lion’s share of private technology markets. These limited partners who can run the money valve and stop it at the will. And their behaviors, and the way they interact with the main transformations in the economy and the stock market, which can (do and do) reorganize the entire market system.

There has been a lot of research and data since 1970s This only shows the extent of the private market league – and the difficulty of raising money from LPS during stagnation (see here). In modern history, financing for VC companies He falls To about 50 billion dollars worldwide in 2001 from 88.4 billion dollars in 2000, and decreased to 22.7 billion dollars in 2009 from 53.2 billion dollars in 2008, according to Cook.

This course, in which we find ourselves, was wonderful in itself. First, you had an adventure boom due More than a decade From low interest rates. After that, the 2022 bear market provided many action plans after recovery, followed by unprecedented amounts of money plowing in artificial intelligence companies. But the artificial intelligence boom missed a standard component in the ecosystem of the private market: subscriptions and subscriptions. As a result, the limited partners did not get many distributions for a period of three years.

It is not surprising, then, for VC donations to be free since 2022 – almost all available capital has flowed into a small group of money. Last year, 75 % of all the capital VCS collected to Only 30 Investment capital companies, according to Pitchbook (see data here). Only nine companies raised half of all of that capital. About eight out of every 10 limited partners say they refused to restore investments in at least one VCS in its wallet last year, according to Coller Capital. Annual scanning.

The expectations this year were that the VC sector was to restore its groove. Many Silicon Valley elites hope that Trump’s approach to combating organization alive Integration and purchase activity. The public subscription pipeline began to fill again. The first appearance in the public market in Coreave was the sidewalk that some people may want to get – the matter ended with AI Datacester to reduce the amount of money that it collected, and its shares have been overcome since it started trading on the NASDAC Stock Exchange – but there was hope to be other candidates in IPO, with the cleanest budgets, may fade.

With the speed of Trump’s definitions, however, the equation changes. Investors and founders of startups now should consider the very real possibility of the continuous bear market or stagnation. Companies like Clarna and Stumbhub have already decided to put it Subscription plans. So not only LPS Still Do not get those distributions that affect their need, but asset categories such as bonds or infrastructure may start getting more attractive again, and these LP investors may seduce away to something with more liquidity or less risk.

Perhaps we will look back at this moment as a power. Or perhaps the beginning of what could be a major account of the entire ecosystem. Time – or customs tariffs – will say.

We see you tomorrow

Jessica Matthews

x: Jessicakmathews

Email: Jessica.mathews@fortune.com

Send a deal to photograph the newsletter here.

Nina Ajian sponsored the deals department in the newsletter today. Subscribe here.

This story was originally shown on Fortune.com

https://fortune.com/img-assets/wp-content/uploads/2025/04/GettyImages-1242033218-e1744082629580.jpg?resize=1200,600

2025-04-08 11:22:00