Beterbiev Vows To Be 10% Better For Bivol Rematch

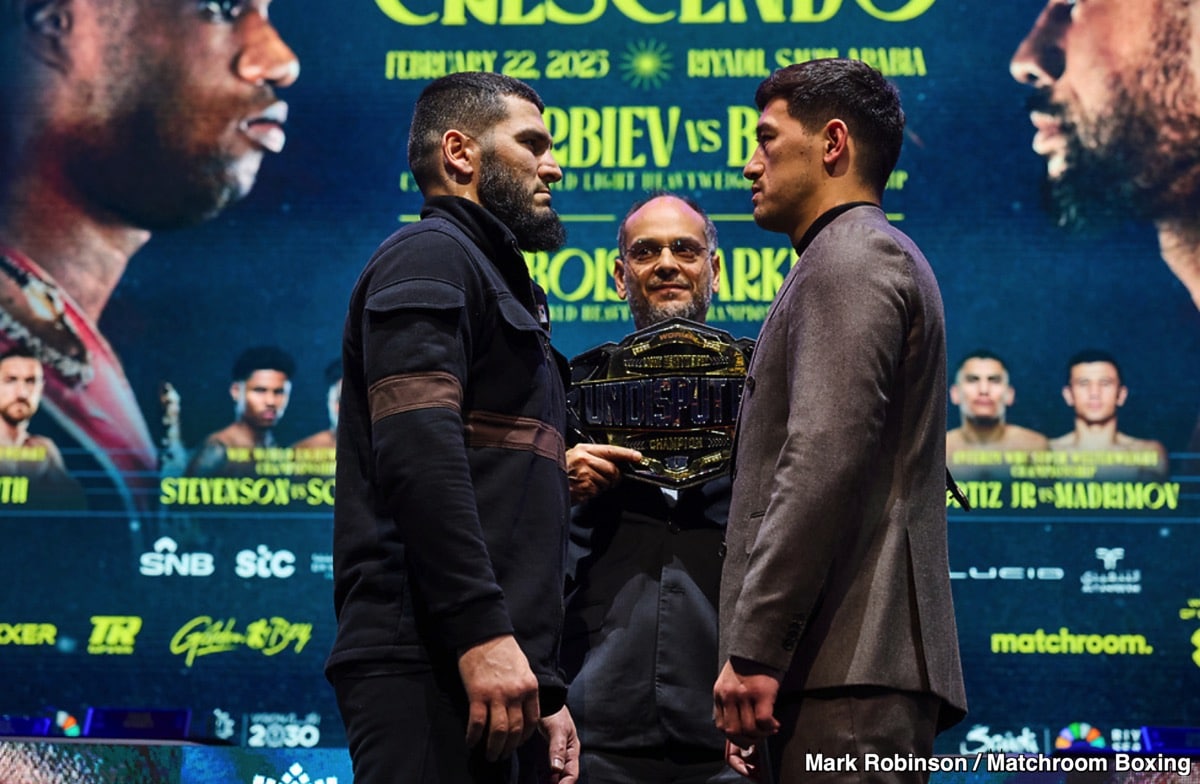

Artur Beterbiev says his team has made some changes in training and hopes to improve by at least 10% ahead of the rematch with Dmitry Bivol on February 22 in Riyadh.

Undisputed light heavyweight champion Beterbiev (21-0, 20 KO) hasn’t revealed the areas he’s improved in, but he’s counting on it being enough to make the fight more exciting.

10% better

The look on Beterbiev’s face during interviews this week suggests he will attack Bivol non-stop and force him to either fight or flee. The last time, Bivol escaped, which saved him from being knocked down, but it cost him the fight. He was very focused on survival.

I suspect that will be his main target this time around once he starts feeling the heat from Beterbiev. Bivol is a good fighter when he’s not dealing with anything thrown at him. But when he throws at his opponents, he bombs or retreats. He’s always fought this way.

“We have changed some things in training. I hope I will be better in this fight than I was in the first fight,” said Artur Beterbiev. talkSport Boxing About his rematch with Dmitry Bivol on February 22. “Before I was undisputed, I wanted to get a fourth belt. Now, I want to keep them.

“If I get some offers for this thing, I’ll look at them. So far, I’ve only received an offer for a rematch and I’ve accepted it,” Beterbiev said when asked if he was open to moving up to cruiserweight after this fight.

“I can take any fight if I have different offers. I will check with my team and accept it,” Beterbiev said when asked if he would be interested in fighting Canelo Alvarez or Jay Obitaya if he defeats Bivol.

“28 years old,” Beterbiev said when asked about his age.

Bevol Tactics

He’s too old to change now at 34, and the only thing he could do differently in the rematch is keep more. That’s what many fighters say he should have done last time. This is what we will likely see more of Bivol to neutralize Beterbiev’s attack.

Last time out, Beterbiev started slowly, allowing Bivol (23-1, 12 KOs) to win the first quarter of the fight with jabs and quick left and right combinations.

Beterbiev started to look like his usual self mid-fight. Bivol became confident and showed no respect to Artur like he did in his recent fights against Malik Zinad, Lyndon Arthur and Gilberto Ramirez.

Bivol clearly misjudged Beterbiev and paid the price as he took over the fight from the sixth round and never looked back. The results were 115-113, 116-112 for Beterbiev, and 114-114.

Interestingly, many fans and fighters are rooting for Bivol to win the fight. They believe he did enough to win the first fight, even admitting he didn’t look like he won a single round of the sixth. They still think he won. It doesn’t look like Bivol won.

For Bivol to win, he will need to fight more aggressively as well, because Beterbiev will put more pressure on him this time. The referees preferred Artur’s attacking style to Bivol’s retreat.

“If I have a 10% chance, I will be much better,” Beterbiev said. Queensberry Offers About how much improvement would make him happy about his rematch with Bivol. “I can’t tell you. You’ll tell Bivol. I know you’re talking about me and Bivol,” Beterbiev said when asked about areas he wants to improve.

“I hope and believe it will be a more interesting fight than the first fight, because now we know each other,” Beterbiev said of the rematch with Bivol.

https://www.boxingnews24.com/wp-content/uploads/2025/01/beterbiev-bivol-22.jpg

2025-01-15 06:31:00