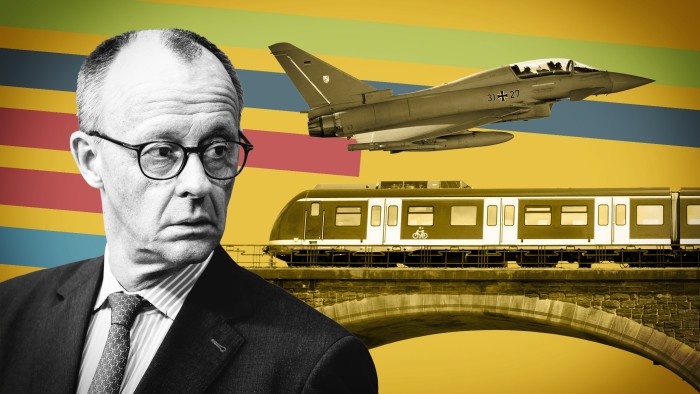

Germany’s ‘whatever-it-takes’ spending push to end years of stagnation

Friedrich Mirz’s plan, “All It takes it” to unleash defensive spending and reform German infrastructure has been appointed to enter into the largest economic incentive since the fall of the Berlin Wall.

Although the details still need to overcome, the historical deal between the waiting advisers and potential coalition partners, socialist Democrats in the center allows unlimited borrowing of defensive spending and creates a fund worth 500 billion euros for 10 years to pay infrastructure investments.

Economists expect that the plan, which still must be agreed by two-thirds of the Great Generations in Parliament, can provide up to one million euros of additional borrowing over the next decade-an amount that represents more than one-fifth of the entire economic output in Germany-and to revive the largest economy in Europe after years.

“This is very good news of military ability and economic growth as well,” said Jeans Sodom, a professor of international economics at Heinrich Hein University in Dusseldorf.

The plan is also separated with more than two decades of the financial province, and it places government spending on the right track to apostasy at a pace that you have not seen since the fall of the wall in 1989, as economists at Hamburg Commercial Bank expected an increase in debt level to GDP from 63 to 84 percent.

“All the speed with which this and the volume of possible financial expansion takes place, it reminds us of the German,” said Robin Winkler, economist at Deutsche Bank.

In the five years that followed in October 1990, German debt levels increased from 41 to 60 percent of GDP, as the country increased public investment in the infrastructure of the former German Republic.

Since then, successive governments have adopted a model for controlling the financial soul that has led to years of investment in general infrastructure-which has an increasing deficit from Deutsche that trains To arrive on time.

“I am looking forward to this day in the future – may still be somewhat far – when German trains may work quickly and reach those in France, Switzerland or Austria,” said Holger Schmiding, an economist at Bernberg Bank.

At the heart of the problem, the “debt brakes”, written by Germany’s constitution in 2009 at the height of the global financial crisis, which limited the government’s ability to obtain new debts to 0.35 percent of GDP-one of the most anti-borrowing laws in history. A lot of the financial space that was on the state of luxury and social benefits was spent.

MERZ plans exceed the brake by enabling the exclusion of everything more than 1 percent of the gross domestic product spent on the defense. Goldman Sachs expects the German defensive spending plan to pay to 3.5 percent of GDP by 2027 – an increase of 2.1 percent in 2024 and 1.5 percent only in previous years, according to NATO.

Mirz’s decision to avoid financial restraint comes amid a quick disclosure of security relations between the United States and Europe. With Donald Trump threatening to end the American security guarantees, at least temporarily cut off Ukraine supportMirz said Germany had to get rid of handrails to defend Europe against “threats of freedom and peace.”

While the German borrowing costs rose more than 17 years on Wednesday, economists did not feel astonished by the potential repercussions of debt sustainability.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said that even with the debt rate to GDP of about 84 percent, the German public lever “is somewhat favorable” compared to most of its peers.

It is widely expected to enhance the resulting high borrowing.

“[It will remove] “Many obstacles that hindered the economic growth of Germany recently,” said Sebastian Dalin, Director of Research at the Institute of Kid Economy Policy in Dusseldorf. He said he believed that the growth rate of 2 percent – is almost in line with the average of Germany of 1.8 percent over a period of 15 years to the epidemic – is now possible.

Nickels Garnad, the economist in Goldman Sachs, said that a growth rate of 2 percent is now on the cards as soon as 2026 – a double expectation number of the Investment Bank of 1 percent, before Mirz revealed his plan.

Some infrastructure projects, such as the investment plan worth 53 billion euros for the railway infrastructure in Germany between 2025 and 2027 that were embodied late last year, “ready for the shovel”, provides the ability to increase growth immediately or less.

Increased defense spending may have a less impact on growth than other general spending forms, given the constant dependence of Europe on US defense products.

At least 21 billion euros of the 100 billion euros fund has been used by Berlin to reform the armed forces in 2022 to purchase the American F35 fighter aircraft, the American engineering, Chinuk helicopters and Patriot air defense systems.

“It will take a few years to raise the level of the local defense industry,” Winkler of Deutsche Bank said, although it was optimistic that higher military spending could increase the potential growth rate in the country by raising more innovation.

A spokesman for the German Ministry of Defense said on Wednesday that the government will aim to direct funds not only to the largest companies, but also smaller companies and startups “to create useless effects on the entire economy.”

The shares of German defense companies, including Rheinmetall, Hensoldt and Thyssenkrup, continued to gather them on Wednesday after Mirz announced the previous night, and build several weeks of gains.

After years of concern about manufacturing, which is looming on the horizon amid high energy costs and difficult competition from China, the batch gave to increase local manufacturing a new contract of life for troubled giants such as Volkswagen, whose shares were close to 5 percent on Wednesday.

Some economists have argued that the inactive productive capacity in the non -manufacturer of the defense industry can be reused.

The advertisement of the infrastructure package also strengthened Heidelberg Materies and Hechtief, which was among the best German blue chips on Wednesday with gains of 14 percent.

The fund of 500 billion euros will fill a lot of gap in spending of 600 billion euros to fill it to improve its infrastructure. The estimate of 600 billion euros, which was made by Think-Tanks IW and IMK last year, said that a third of the number would need to spend on carbon removal and 177 billion euros on local infrastructure.

The skeptics warned that the plan will be far from treatment.

Matthew Morgan, head of fixed income at Jupiter in Asset Management, said that the economy of Germany is still facing “huge structural challenges” such as the most stringent global competition in manufacturing, which is the elderly workforce and expensive energy.

With the possibility of a trade war with the United States, the President of Diw Marcel Fratcher said that the geopolitical risks still “outperform the positive effects of local policy at least in at least two or two years.” It was likely that “German GDP” was still likely to “contract in 2025 for the third year in a row.”

I Isabelle Matius Yagu, chief economist in BNP, said that she does not share this dark view. While the investment batch will take time to increase growth, the “shock of positive trust” can have immediate effects.

She added: “[This] It will be a particularly welcome at this time of historically high geopolitical uncertainty. “

Additional reports by Ian Smith in London; Data depict the written by William Crofton and Clara Murray

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F842d58a2-d352-4c18-82e7-f8515fa3b23d.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-03-06 05:00:00