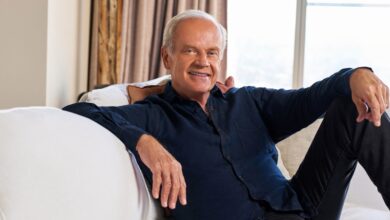

Reba Alum Christopher Rich’s Post-Stroke Health Battle in His Own Words

Ripa alum Christopher Rich Frankly discussed his way to recovery after diagnosing a stroke in the brain after a huge blow.

Rich rose to stardom playing Alexander “Sandy” Korean Another world In the early eighties. From there, Rich continued to appear unforgettable appearances in shows like The nanny, e and Murphy Brown Before recording his disturbance Ripa As Brock.

Ripa Rich made a familiar name after playing Reiba McentireFormer pair of Brock from 2001 to 2007. continued to appear on Boston Legal, desperate housewives and Melissa and Joy Before slowing after intimidating health.

“After stroke and brain injury, it seems as if I had an atomic bomb. So everything is shocked, which is a difficult reset.” US weekly In February 2025, before the guest spot on NBC’s Happy place. “After I finally got out of the hospital, I was wandering again. Then I threw a group of blood clots and I finished in the hospital with lung and debris on my heart. After surviving all this nonsense, I really feel good.”

He continued: “I lost 50 lbs since the last time I was regular on TV. I no longer have a lot of appetite anymore. But I am not disappointed by losing weight.”

rich He was hoping for his return For Hollywood, adding, “It is great to be able to be a disabled person and play a disabled person. I hope that when some of this comes out, the people I have worked with in the past will say,” Well, let’s return it. We can work with him. “

Although his life changed due to the painful brain injury, Rich remained positive about his continuous recovery – and His return to acting. He continued to pass on everything that Rich said about his healthy food, and life after suffering a stroke and how he gave priority to his recovery:

The primary health issue

Christopher Rich, Melissa Petramman and Riba Mentier in Ripa.

Evert Group“I was almost not to the Easter service in the church because I was busy with a huge strike,” Reach recalls in a video in 2022 to the Renewal Medicine Clinic. “It was a big struggle, but part of my treatment comes here to get a treatment for stem cells to heal the right side of my mind where the blood clot occurred.”

rich How stroke collapsed The ride side was damaged by his brain, weakening his ability to walk, speak and use the left side of his body.

“Some of my mind has destroyed, so what I was doing was that I was trying to re -develop nervous paths,” continued at that time. “My left sides were completely frozen. I couldn’t walk or use my left arms.”

Developing a new rental contract for life

Melissa Petramman, Christopher Rich, Ripa McCaine, Scarlett Pommers in Ripa.

Greg Schwartz Group/Fox TV/Evere courtesyAfter suffering a stroke in 2018, Rich was reflected in his health in a promotional video of a medical center, saying: “Some stem cells have been injected into my shoulder a few days ago, and the pain decreased by 80 percent. I have more movement. I am better walking I am still talking like a fool, but I don’t think this will change. “

Rich has admitted that he has since looked at his life differently. “When you face a big medical problem, it changes your view of life,” he pointed out. “When you come through it, you start enjoying every day a little more even with pain.”

The actor said that his health has become a priority, which means that it is a “dangerous deal” for him to travel From Los Angeles to Texas “To get the highest quality treatment.”

Confronting the rise and landing

Rich discussed his mental health in the 2019 video of the nerve skills center.

“after [you] He suffers from a brain injury, it seems as if everything has changed in a moment and now you are in this other place. He explained that there is hope that this is the place where the sun rises to me. “Treat others well because you will rely on it, and don’t forget to ask others to help because you can use all the help you can get now. … You are in the right place and I am very sorry because you have to do this, but I am happy because you have found this The place will take care of you well.

Rich was formerly married to the late Nancy Frangion From 1982 to 1996, with which one daughter was adopted. he I found love again with Eva Halina Rich The couple, who participated in two daughters, married in 2003. Eva joined Christopher in a video of the medical center where he recalled the effects of “huge stroke”.

“My wife and I are still working hard to re -establish our relationship because it is similar to that she lives with a different person,” I admit. “I am frustrated with the fact that it does not know that it is the same man who is still here. But it is like,” this is an amendment. “I don’t think I will be exactly what I was before and I hope it is not because this was an educational experience for me.”

First year

“I went to sleep the night before Easter and when I woke up, I couldn’t walk or speak firmly. I was stroke in the middle of the night, and after that I had a complete left side paralysis. There was no use in my left arms at all. I couldn’t walk On my own. “I was on a wheelchair. The left of my mouth. “

Christopher pointed out that the memory was a major issue as well, adding: “I have these dreams at night as I wake up the next morning and I have been completely recovered. As much as I want, some morning I wake up and try to extend to move again, and I realize that I do more than I did Yesterday morning.

He continued: “I have a great life thanks [the medical center]. Bad things and you can do, “Why am I?” But there is for you to grow. This does not prevent you, not the end of the road. It is the beginning of a different road. I would like to say that the central nervous system saved my life. I really re -merged into that life there. “

Return from work to focus on his health

Reba Mcentire and Chris Rich in “Reba”.

Danny Field/Fox TV/Evere Group“If you are an actor, you cannot suddenly appear again [after suffering a TBI] And say, “I can do it.” Fortunately, I found something [new]. “I miss the behavior a little, but not as I thought,” he said in the 2019 video clip of the nervous skills center. “It was my main motivation during my life, but the other thing that I did a lot is charitable work and really miss more than being a representative.”

Christopher continued, “I have been able to do something that I have long participated in. It is a green energy program for unpleasant generators, especially for remote islands and places.”

Return to its roots “Reba”

Reiba Mcentire, Chris Rich and Rex Linn.

With the permission of Chris Rich/InstagramAfter taking a break from the acting, Christopher appeared as a guest on NBC’s Happy place. Rich -gathering with mcentire and Melissa Petmanand Who were on his visit Ripa. Christopher played a local tattoo artist on Happy place His name is Maverick, who liked to bother new clients about any hand he would use in tattoos to them after being stroke that affected his left side.

“Make the crew feel like it was the old Ripa group because we were exposed to an explosion. They enjoyed the same amount of fun as I did and that was really sad for me. He told me that I went home in a safe place.” we. “I took care of well. It was a blessing. I want to return very badly.”

https://www.usmagazine.com/wp-content/uploads/2025/02/reba-alum-christopher-richs-post-stroke-health-battle-in-his-own-words-promo.jpg?crop=0px%2C64px%2C1616px%2C849px&resize=1200%2C630&quality=55&strip=all

2025-02-19 15:00:00