Keyshawn Davis Under Fire: Fans Blast “Truth Will Reveal Itself” Apology After Missed Weight & Stripped Title

Keyshawn Davis criticizes an apology for what happened to what was supposed to be a defense of the title on June 7 against Edwin de Los Santos.

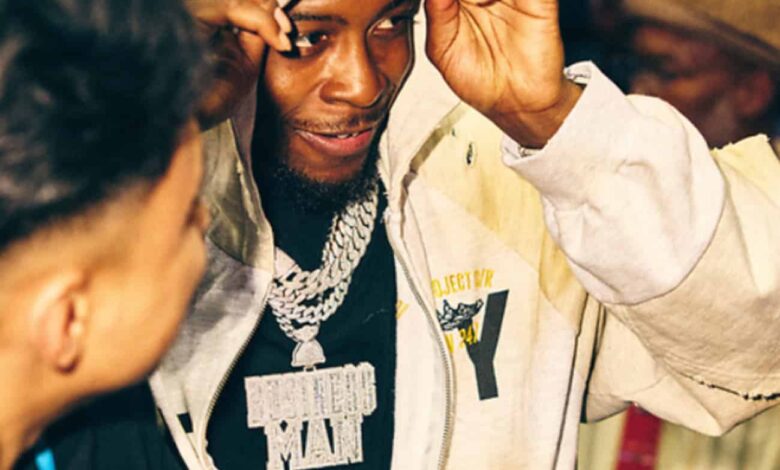

(Credit: Geoffrey Knott/Matchroom)

Keyshawn Davis reaction violently

What anger of the fans is the way the WBO hero in WBO, Keyshawn retreated at the end of his written apology, saying, “In the end, the truth will reveal itself.” The statement indicates that Davis plays the victim’s role, although he was the one who missed the weight and was involved in the dressing room that night with Nahir Albright.

Accountability: Davis under the fire

The fans see this note as a sign that Davis does not want to bear accountability for obtaining 4 pounds of extra weight to defend the title against De Los Santos, then he was stripped of his title in WBO. Di Los Santos promoter was not allowed to take the largest keyshawn under these circumstances.

Davis-Albreette details of the fight

Then there is also the accident in which Keyshawn took place to the Nahir Alright clothing room after defeating his brother Kelvin Davis. Ulbright claimed that Kishon jumped.

“I apologize to everyone who was affected by it. I allowed supporters, especially the young people who looked at me. I will give a better example. In the end, the truth will reveal itself,” said Kishon Davis on Instagram.

It took approximately three weeks to Kishon to release his opponent. Ideally, he should have done this a day after weight loss and participation in the dressing room. Some fans want Keyshawn to be suspended for what happened.

The truth will reveal itself

If it is Davis’s promoter who advised him to issue an apology in an attempt to improve his general image, they should edit the last part, “In the end, the truth will reveal itself.” This comment indicates that Keyshawn tries to get out of responsibility for what he did on June 7.

What is the truth that can change the weight of the missing keyshawn? There is nothing that can be explained away.

Last update on 06/27/2025

https://www.boxingnews24.com/wp-content/uploads/2025/05/Keyshawn-davis4332.jpg

2025-06-27 07:38:00