What Tesla’s tarnish tells us about America Inc

Digest opened free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

Among all Trump’s ski -hitting deals, Tesla stands out. The price of Elon Musk’s Electric Company fell from the highest level after the election, which is approximately $ 480 to less than 282 dollars last week. The fall was so huge that last Thursday, the American Federation called for the teachers, an American union representing the members of 4 meters in retirement investments, six large money managers – Black Rock, Vanager, Street State, Tr Roce, Fidelti, to Tia – Reconsidering their position In the company.

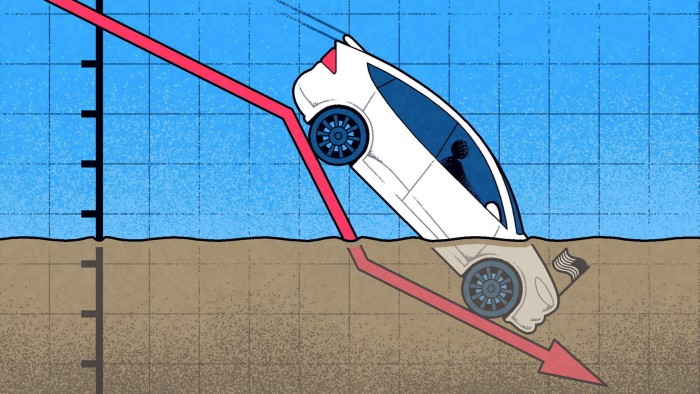

As the head of Aft Randi Weingarten said, Tesla Stock was drowning “faster than Cyberrtruck in Quicksand”, with European sales in particular from the abyss. The latest financial statements of the company show a decrease in public income on an annual basis by 23 percent, as the total profit margins slip 138 points in the fourth quarter.

Sales in California – a major electric cars market – decreased by 8 percent in the fourth quarter of 2024, according to vehicle records issued by the California New Car Association. Of course, this is nothing compared to sales sales on an annual basis of 60 percent year on an annual basis in Germany.

Some violent reaction is political. The gestures that appear to be well greeting the Nazis do not decrease with the Europeans, and do not call for the dismantling of the Ministry of Education with teachers. But even if Musk is not exhausted, the company’s share price has become “completely absolute of the basics,” he said JPMorgan analysis a month ago. Moreover, the reasons that made the Tesla brand very distorted with the greater decline America company

Just as Trump exaggerates the excessive Trump and horsemen (remember the line about the prices that decreased his first month in his post?) As well as musk. Start with the fact that the Chinese car maker BYD exceeded 2024 sales estimates of about 20 percent, even with Tesla mentioned her first full year. Decrease in vehicle shipments Since 2011. This is the result of BYD significantly reducing its costs compared to competitors by taking advantage of vertical integration, ownership of supply chains (BYD manufactures their batteries) and Dougha size.

This is the magic formula of Chinese industrial policy – continuous repetition on a large scale that maintains increased productivity and costs. State support in areas such as electric cars that support expansion. But after Biden, the United States has no industrial policy in clean technology. Trump ends the federal support for building charging stations, which has benefited greatly from Tesla, and perhaps the tax incentives for electric cars will also reduce. Musk may be able to attend the cabinet meetings, but at the end of the day, large oil He runs the Republican Party Trump is not an interest in supporting clean energy transmission. This does not preach good for an American company trying to get rid of a Chinese national hero.

Tesla did not focus on the price, but on being a distinct brand. This is the Apple strategy. But to charge a bonus, you should be seen as a certain luster and cache on the market. The political strangeness of the musk has reduced the value of its brand in many parts of the world. Sales crashed in Europe after announcing his support for AFD in Germany.

Dutch pension fund was declining from Tesla in protest in early January. Tesla owners in France, Norway and the United Kingdom reduce the abundant stickers that have read: “I bought this before we know that Elon was crazy.” In Germany, the general protests in Tesla factories are common (I recently received an invitation to one of them in Brooklyn). All this may erode pricing power in Tesla and the value of its high -tech and sustainable brand. According to Stifel Stephen Jinjo analyst, the TESLA is the vivicing TESLA classification, which measures the consumer perception of the brand, close to its lowest level ever.

Tesla’s fall reflects a greater feeling that the exceptional in the United States, especially in technology, may be at the end. Some of this is due to a more solid competition from China (Deepseek surprised a sharp correction in American artificial intelligence shares) and the fact that the technology separation will inevitably close American companies from large markets. Tesla sales were delayed in the total market growth in China, as the organizers were slow to agree to the self -driving Musk program. Looking at the policy of the relationship between the United States of China, it is difficult to imagine that Tesla will be able to advance before competitors such as Waymo in areas such as independent cars.

Meanwhile, competitors are gathering at home and abroad to threaten Tesla in the EV infrastructure. Mercedes -Benz, BMW, General Motors, Stelncis, Honda, Hyundai, Kia and Toyota Euna, a competitive initiative at the US shipping station in the United States plans to deploy 30,000 stations by 2030.

Will money managers listen to Al -Ittihad calls to review their position in Tesla? I hope so. The frequent Musk ads about the ambitious projects that the company is supposed to (do not bet on the success of human robots outside Japan) has an atmosphere of recklessness. The disputed payment package is both obscene and unjustified. As AFT indicates, the JPMorgan analyst occupies a $ 135 goal for Tesla. If the stock price decreases to this, the decrease in prices from year to date will reach 64 percent.

This will be a dangerous blow to investors. I was arranging Tesla, like the United States itself these days, as selling.

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F90766694-d108-4995-92e2-29bcca0ee06b.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-03-03 05:00:00