Apple’s Steve Jobs dealt with the 2008 financial crisis not by layoffs or slimming spending but by investing his way through the downturn—and it paid off

- apple The co-founder Steve Jobs previously revealed how you deal with the Dot-Com bust And subsequent economic contraction. Instead of lowering jobs or budgets, the late CEO gave the priority to “Invest) on our way through shrinkage” – just two years after the 2008 financial crisis, I issued Apple iPad.

Economic uncertainty is a challenge For entrepreneurs of all shapes and sizes, even with a simple signal of anxiety sending the shares of the company.

However, Steve Jobs was a master in maintaining his head high-and his playing book to move in the 2000 Dot-Com explosion and the 2008 economic crisis may be just a plan that needs business leaders today.

Associate founder Apple Talk to luck In 2008 About economic shrinkage at the time.

He said: “What I told him is that our company is that we will invest on our way through shrinkage.” “We will not offer people, and that we have made a huge amount of effort to make them in Apple in the first place – the last thing we will do is get rid of it.”

Instead, Jobs revealed that the company’s budget (research and development) was increasing for the company, “so that we are applying to our competitors when the recession ended.”

“This is exactly what we did,” added the late CEO. “It has succeeded. This is exactly what we will do this time.”

In 2003, while other companies were still recovering from the collapse of technology shares, they released Apple iTunes. NASDAQ-100 lasted more than 15 years to return to its peak in the Dot-Com era. But in the meantime, Apple unveiled the iPhone and the application store.

By the time when the recession revolves in 2008, Apple was still selling millions of smartphones and computers. Just two years later, the iPad was released.

According to Business review at Harvard UniversityOnly 9 % of companies flourish after an economic slowdown – like Apple, companies that make smart investments when the chips decrease a better chance to become leaders in their market.

Apple moves one of its rock periods at all

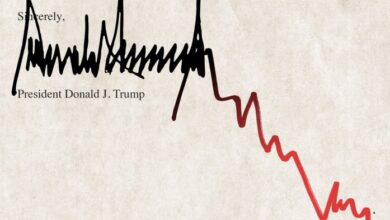

Apple’s shares have been its best day since January 1998 yesterday from news that President Donald Trump will stop Its wide tariff plans-which caused the fall of the market.

However, it is unlikely that champagne will be passed at the company’s headquarters, given that the trade war with China has just started.

Trump’s increase in a tariff on Chinese goods to 125 % informs the bad news of the company, creating most of its distinctive electronic products abroad. According to Wedbush, Apple produces about 90 % of iPhone devices, 75 % -80 % of iPad devices, and more than 50 % of Mac devices in China.

Experts tell luck Any tariffs are probably transferred to consumers, which may lead to the worst scenario of the worst cases where it is unlikely to tolerate the new iPhone 16 products.

While Jeff Fieldhack, research manager at CounterPoint Research, Apple expert, believes that Trump’s tariff is still a negotiation tactic-if the trade war extends for several months, it may be impossible for Apple to take the philosophy of Weather-Weather.

The CEO’s response to the uncertainty depends on the cards that are dealt with

Jimmy Damon, CEO of JP Morgan Chase His management style during the 2008 financial crisis With more practical training, but given that banks were in the midst of collapse, it can be said that he had no other option.

Make How leads leaders Podcast That “then” from Bear Stearns, Alan Schwartz, called him one night with a blatant request: He needed $ 30 billion that night.

JP Morgan was ultimately able to buy the company later that week and avoid the collapse of a more dramatic market, but Dimon said it succeeded because it gave priority to capital, liquidity and profitability as soon as he became the CEO in late 2005.

After working from 5 am to 10 pm every day, five days a week, for the rest of the crisis, learn a valuable lesson on how to drive volatility: “serve your customers, do a great delay work – not only UPS. Do not celebrate the emerging entry, be ready to enter.”

This story was originally shown on Fortune.com

https://fortune.com/img-assets/wp-content/uploads/2025/04/GettyImages-51005277.jpg?resize=1200,600

2025-04-10 15:41:00