How Donald Trump’s tariffs threaten an iconic US pick-up truck

Open the newsletter to watch the White House for free

Your guide to what the American elections mean 2024 for Washington and the world

Chevrolet Silvrado has been one of the most popular pickup trucks in America since it was launched almost three decades ago. But the iconic car can now become one of the largest victims of the Donald Trump trade war.

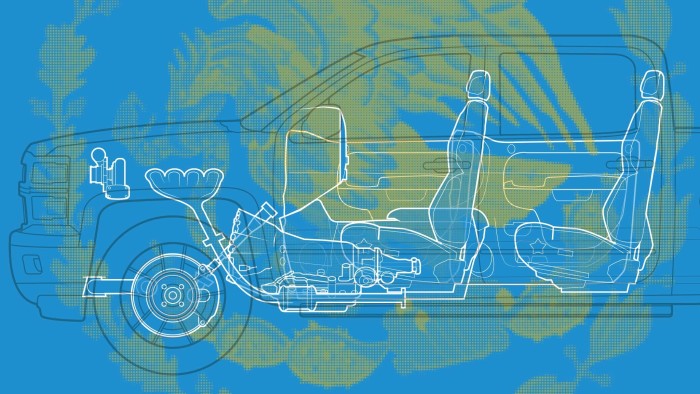

The GM model, which costs approximately 40,000-70,000 dollars, depends on one of the most complex, international and interconnected cars, which makes it especially vulnerable to the US President’s threat to impose a 25 percent tariff on Canada and Mexico.

Of the 673,000 Silfados produced last year, 31 percent was built at General Motors Factory in the Mexican city of Silao and 20 percent at its factory in Ushaawa, Canada.

But even for almost half -manufactured in three American plants in Michigan and Indiana, it is possible that the routers and doors trim in Mexico are built; The rear lighting in Canada; The airbag unit in Germany; The focused stack screen in Japan, according to global mobility data.

Financial director Paul Jacobson told a conference for investors last month that General Motors has been preparing for tariffs since Trump was elected.

The car maker turned some production and lower in stocks in plants outside the United States by about a third of “because the last thing you want is a group of final stock.

He said that if the definitions become permanent, the company will need to think if it will transport the plants. But with uncertainty, General Motors cannot spend billions of dollars on “collecting business back and forth.”

Data collected by export genius shows that the main components of Silverdos depend greatly on the imported parts of Mexico. The value of the country’s parts exports to the car amounted to approximately 30 billion dollars last year, as the braking systems alone represent $ 4.3 billion.

Trump threatening The tariff on Mexico and Canada in early February, and then announced its recovery for 30 days before it came into effect-but on Thursday he pledged to pressure the front from March 4. The turmoil will be worse if the fees expanded to the goods imported from the European Union and the rest of the world.

big Fear in industry It is that Trump will impose a comprehensive tariff without mechanisms that are usually present to alleviate their impact, such as defect programs through which fees can be recovered in the end if imported goods are then re -exported.

“This is not a commercial action. This is it Border security Dan Hirsch, the leader of the Americas in the field of automotive and industrial in Alixpartners, said, referring to the Trump argument that he was a tariff in response to the flow of illegal immigrants and drugs across the Mexican and Canadian borders. “It is a large hammer, so this is the challenge.”

Mike Wall, CEO of Automotive Analysis at the S&G Global Mobility, said companies are “deep diving” in the supply chain to determine the suffocation points. He added: “If they can and wherever possible, they will try to change some of these sources.”

But the shift in manufacturing from Mexico to the United States will take time and cost, while the high price of employment will raise production costs.

Jim Farley, Ford CEO, warned that “billions of dollars In industry The profits can be eliminated “if there is a long tariff for imports from Mexico and Canada.

John Elcan, President of Chrysler Stellantis, called on Trump this week to keep goods from Mexico and Canada free from customs tariffs. Instead, he urged the United States to close what it described as “a vulnerability that currently allows about 4 million vehicles in the country” without American content requirements, as is the case with cars made in Japan and South Korea.

Wilddo Gomez Zuba, professor of economics at the National University of Self -Government for Mexico and a researcher at the employment and labor consulting center in the country, said the definitions will raise the price of vehicles such as Silvrado, which will harm the demand – and the migration problem may worsen.

Gomez Zuba said that the workers of GM’s Silao Plant received $ 5.50 per hour. But the company cited the threat of definitions last month when it refused a suggestion from the factory federation to raise wages.

Definitions “It will change the path of integration that the three countries have been since 1994,” he said.

He added that GM, Ford and Stellantis run their Mexican factories in the areas that have already had a major migration.

He said: “If these companies are closed, and they will affect the entire regional labor market, and therefore we expect migrations to rise from that region.”

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F3db6309d-1fa6-436e-a2f2-98d9dc6b7111.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-03-03 05:00:00